Thought Leadership

Valuations and the M&A Markets: what are the leading strategic buyers saying?

10th June 2022

By Sheana O’Sullivan

The recent statements from Sequoia Capital and others are gloomy. They say good times are over, growth is no longer being rewarded and companies should buckle their seat belts and focus on cash. Lightspeed Ventures says ‘The boom times of the last decade are unambiguously over.’ Most people are saying that this time we’re not going to see a swift V shape recovery in the markets like we did after the onset of the Covid-19 pandemic, but we’re in for the long haul.

Curious to see how current market disruptions are affecting M&A, I spoke with some of the leading strategics in Silicon Valley and Europe to get their insights. How are leading corporates reacting to the slowdown? How is it affecting their M&A plans? What is happening to valuations? What’s the outlook for the future?

Here’s what I discovered.

How are leading corporates reacting to the slowdown? How is it affecting their M&A plans?

The general feeling amongst buyers is that there is an opportunity to acquire strategic assets at more attractive valuations, although there was a clear hesitancy around companies that are burning cash or do not have a clear path to profitability. Many recall the period after the Great Recession in 2007 when M&A volumes collapsed as a missed opportunity, where great returns were made by those who kept their focus and their nerve.

Some of the specific comments were:

- According to the Head of M&A at one of the most active private acquirers in Europe, a slowdown is not a big issue because they are looking for strategic assets where they buy for synergy and long term value, not because they intend to sell it on.

- The Head of Corporate Development at a leading IT Professional Services firm is looking forward to less competition from PE funds and believes there is a good opportunity for ‘strategic buyers’ to find good quality assets in Europe.

- Another well-known acquirer and leading provider of ERP and CRM solutions in the US agrees with a less competitive market, and is actively looking for attractive assets in Europe at lower prices than the “frantic” days of 2021.

- The Head of M&A at a leading customer experience management company echoed the attractiveness of acquiring targets for strategic product capabilities that are additive and provide cross-selling opportunities across their existing product lines. However, he sounded a note of caution and a change in approach, saying that it’s not growth at all costs and their board is keen to avoid any impact from the company’s burn and cash flow, so high burn is a key issue.

- There’s been no impact of an economic slowdown on the M&A plans for a leading acquirer in GRC software. Debt-free, they can self-finance any deal, and while they are still willing to pay good valuations they are more hesitant around companies that are burning cash or breakeven.

- Lower valuations are a good thing for one Head of Corporate Development at a leading data analytics company in the US, although he’s less enthusiastic about the drop in value for his personal stock market account.

Most of the people I spoke to said they are expecting a reset in the market over the next few quarters, and several are planning for a recession. The good news for sellers is that M&A remains a strategic priority for most, but companies that have no clear path to profitability will be less likely to find a buyer, and buyers are expecting to be able to strike deals at lower valuations certainly than were realized during 2021. For founders and shareholders holding out for high valuations there is clear potential for disappointment, which may mean a slowdown in volumes as sellers decide not to sell and to hold on for longer.

What is happening to valuations?

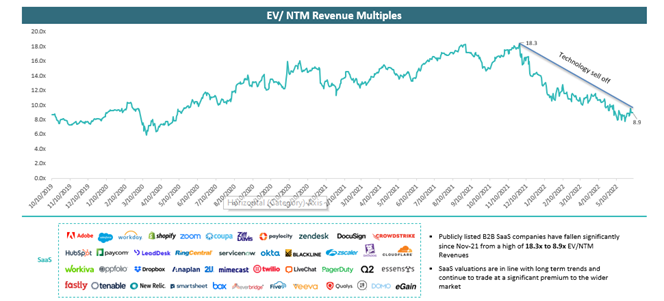

Since the peak in November 2021 there’s been a sharp fall in the valuation of publicly traded B2B SaaS companies, which are now trading at an average of 8.9x NTM revenue. This is back to where things were 18 months ago, prior to Covid-19.

You can see this in the graph below.

We’re seeing this drop in valuations coming through in the private markets, especially for the more speculative deals and the later stage deals which got particularly overheated in the last year or so, although for mid-market M&A transactions where there is a good strategic fit valuations are holding up better.

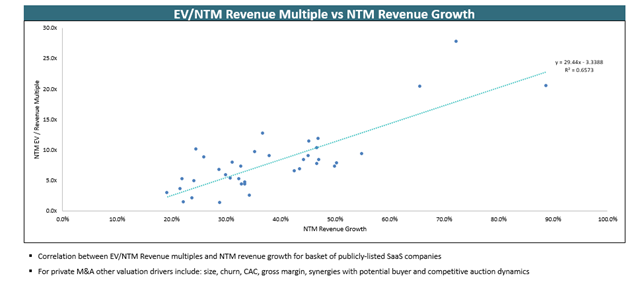

We looked at the correlation between EV/revenue multiples and revenue growth for a basket of publicly listed SaaS companies to see whether the link between higher growth and higher valuation is still true. We can see from the chart below that growth remains an important driver for valuations, so companies that can demonstrate strong ARR growth will still benefit from higher multiples. Of course, the environment is more risk-averse, and other important factors include size, quality of earnings, recurring versus non-recurring revenue mix, churn, CAC and profitability/cash burn as well as the synergies with potential buyer and the competitive auction dynamic.

What’s the outlook for the future?

In summary, according to my anecdotal survey of the leading tech acquirers, we can be cautiously optimistic about demand for strategic M&A, as most seem to view the current market as an opportunity to acquire, with less competitive pressure on deals. We also see good demand for acquiring in Europe. However, companies burning a lot of cash or without strong fundamentals are likely to see a drop in demand, and there is likely to be a gap between buyer and seller expectations of valuation, which will likely lead to lower M&A volumes.

There are plenty of reasons to believe that this slowdown may spawn some of the most interesting companies for the next few years; there is still plenty of capital among deal makers and the digitalization and adoption of technology is steadily making progress across most if not all industries and sectors. More business workflows will be digitized. More enterprise infrastructure will move to the cloud. More consumers and SMBs will come online globally. Web3, AR/VR, AI/automation, and more are all in the early stages of what will surely be substantial growth markets. What lies ahead is certainly a period of uncertainty but there will be plenty of opportunities to be uncovered.